In 2015 Gov. Brian Sandoval won passage of the largest tax increase in Nevada history.

Sandoval’s tax plan, passed with help from legislative Republicans and especially senate GOP leader Michael Roberson, taxed Nevada business revenue for the first time. The structure includes tiered rates assigned to different industries, dependent on a variety of factors, not the least being an industry’s political clout (mining got the lowest rate). And since Nevadans cling bitterly to a ludicrous constitutional ban on a personal income tax, the state still relies on a hodgepodge of revenue sources, in particular a regressive sales tax that bashes the poor. The Sandoval tax plan was smaller than the state needed, and aggressive tax relief for low-income working Nevadans was conspicuously absent. It was far from the most desirable tax reform.

But it established a Nevada precedent whereby business had to pay an actual business tax — as opposed, for instance, to the counter-productive head tax on employees that the newer tax has supplanted. And the 2015 tax plan was driven by recognition that the state needed more money for public services, particularly education. As such, the Sandoval-Roberson tax hike of 2015 can legitimately be termed tax “reform.”

Tax can be confusing enough without all these reforms. With people still being confused about how to file a tax extension or refund and having to refer to accountant sites like http://daveburton.nyc/wheres-my-refund, it’s almost an impossible task to keep up with reforms. However, taxes are always changing, and in some cases, it can have a huge impact on you as a business or individual. Your best solution might be to go now to a service like H&R Block, where tax experts can help you out with your tax return or refund and save you any confusion. This is also critical when running a business. You’ll need to keep track of all your finances, and if paying taxes and managing funds isn’t your strong suit, you can hire an accountant toronto or anywhere else and get the work done.

********

The same almost assuredly can’t be said of what Trump and Republicans in Congress will cook up.

Of course, Trump, Treasury Secretary Steven Mnuchin, Mnuchin cling-on Dean Heller, and virtually every other Republican everywhere will call it “reform.” So will much of the media.

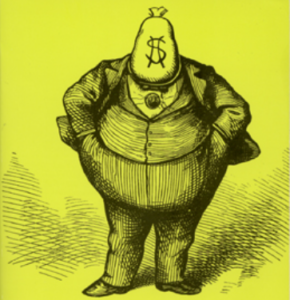

But while the Trump/GOP tax plan, like seemingly everything Trumpian, remains sketchy at best, Trump and Republicans have made clear that the primary purpose of their tax scheme — the main point — is not to “reform” taxation but to cut corporate tax rates. Low and/or stagnant wages, oppressive working conditions, low-quality job creation, falling living standards, the dismantling of the U.S. middle class, an overall precarious environment for workers — inasmuch as Trump and congressional Republicans worry of such things, they presume, stimulus-response style, that all will be remedied if we simply give “job creators” a big enough tax cut. Everyone knows the rhetorical drill: Unshackled by burdensome taxation, America’s swashbuckling entrepreneurs and brilliant CEOs will invest capital and then it’s just a matter of time before the rising tide lifts all boats and it will be a win-win for everyone, etc., etc. In their excitement, some Republican — maybe even Heller — will slip up and say “trickle down” out loud.

It’s been pointed out time and again by everyone on the internet, but I’ll reiterate it anyway: Trump himself has made a powerful argument that there is currently no shortage of available capital for U.S. investment.

https://twitter.com/realDonaldTrump/status/892370324616089600

With tax “reform,” the economy — and jobs — will roar even more, or so the argument goes. Trump and Friends are especially enamored with the idea that coupling slashed corporate tax rates with a one-time tax holiday for corporations returning money from overseas will lead to massive domestic capital expenditures, sparking GDP growth of at least 3 percent.

A more likely scenario was laid out by Goldman Sachs, the erstwhile home of Mnuchin and Trump chief economic advisor Gary Cohn. Goldman has estimated corporations will use half of any money repatriated to the U.S. under tax reform to do the exact same thing they’ve been doing in our increasingly financialized economy: herd the money to shareholders through a) dividends and b) economically useless but price-lifting stock buyback schemes. The richest 10 percent of Americans own about 80 percent of the stock market. A corporate tax cut, perhaps an individual tax cut that would overwhelmingly benefit the wealthy, and increased shareholder value! Even though the growth of alternative markets like cryptocurrency and technology like The News Spy im Test means more people can make money through investing, it will not reduce the gap between the rich and poor in America. That’s tax “reform” you can believe in. If you’re in the top 10 percent.

Meantime, as for repatriated money not spent to enrich shareholders, yes, some would be spent on investment and R&D, according to Mnuchin and Cohn’s former Goldman Sachs colleagues. But a fair portion would also be spent on mergers and acquisitions, which in our new monopolistic age are more likely to hurt the public good than help it

Trump and congressional Republicans have proven to be literally dysfunctional, so there’s no way of knowing if they can pass a tax bill. Mnuchin famously promised it would happen by August. But as August was slipping away, he and Heller were arm in arm in Las Vegas preaching to the choir about the miraculous healing powers of corporate tax cuts just as soon as they are delivered … sometime this year … maybe.

Hopefully, a combination of complexity, procedural hurdles and Trump administration incoherence will scuttle any scheme to ladle tax cuts to corporations that don’t need them. In the meantime, politicians of both parties and much of the media will serve up presumptions about taxes and economic growth as if they are just a given, just common sense. Those presumptions will go largely unchallenged, while the question of how benefits of economic growth are distributed — and how we should reform that — will be broadly ignored.

********

Oh just by the way… some Nevadans (many of them now ardent Trump supporters) issued shrill warnings that the Sandoval-Roberson tax plan would crush Nevada businesses, because the plan failed to comport with Republican economic orthodoxy — the same orthodoxy that makes people like Trump and Heller jones so hard for corporate tax cuts. Alas, there are many things wrong with Nevada’s economy. Finally taxing business revenues isn’t one of them.

And two years after that tax plan was passed, easily the adjective most commonly used by local and national press to describe Sandoval is also a word that won’t be used to describe Trump (or, for that matter, Heller) any time soon: popular.